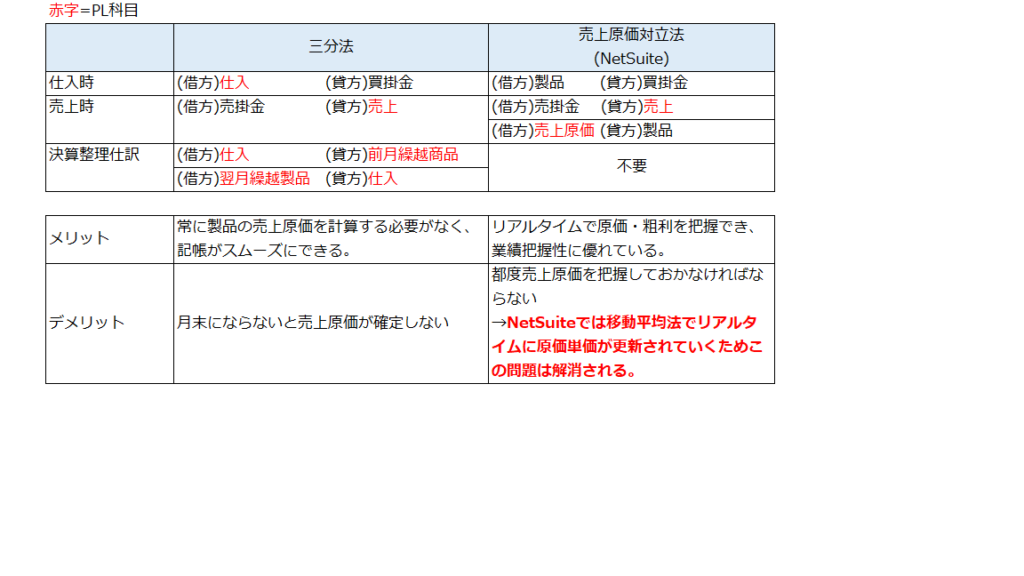

NetSuite uses the cost of sales method. For companies that have traditionally used the three-way method, it may be difficult to imagine what the cost of sales method is, so we have summarized the differences between the three-way method and the cost of sales method, as well as their advantages and disadvantages, for your reference.

As mentioned above, the cost of sales method has the advantage and disadvantage of being able to grasp the cost of sales in real time.

However, Netsuite automatically updates the unit price in real time on an item-by-item basis using the moving average method (*1).

(Even if there is a delay in transaction input (voucher input) and a purchase transaction before sales is entered after the cost of sales of a certain product is recorded, if this affects the cost of sales unit price, it will be automatically updated.)

As a result, for companies that previously calculated the current month’s inventory unit price of items using Excel, the workload of cost calculation will be reduced, manual errors will be reduced, and it will contribute to understanding business performance in a timely manner.

When implementing, customers who have previously used the three-grammar method will also need to change their accounting system (PL cost items), so please be aware of this at the start of the implementation project.

*1 In addition to moving average, NetSuite also offers other methods of inventory valuation, such as FIFO, LIFO, and standard cost.